2307 BIR Form - Fill, Edit Online, Download & Print - No Signup

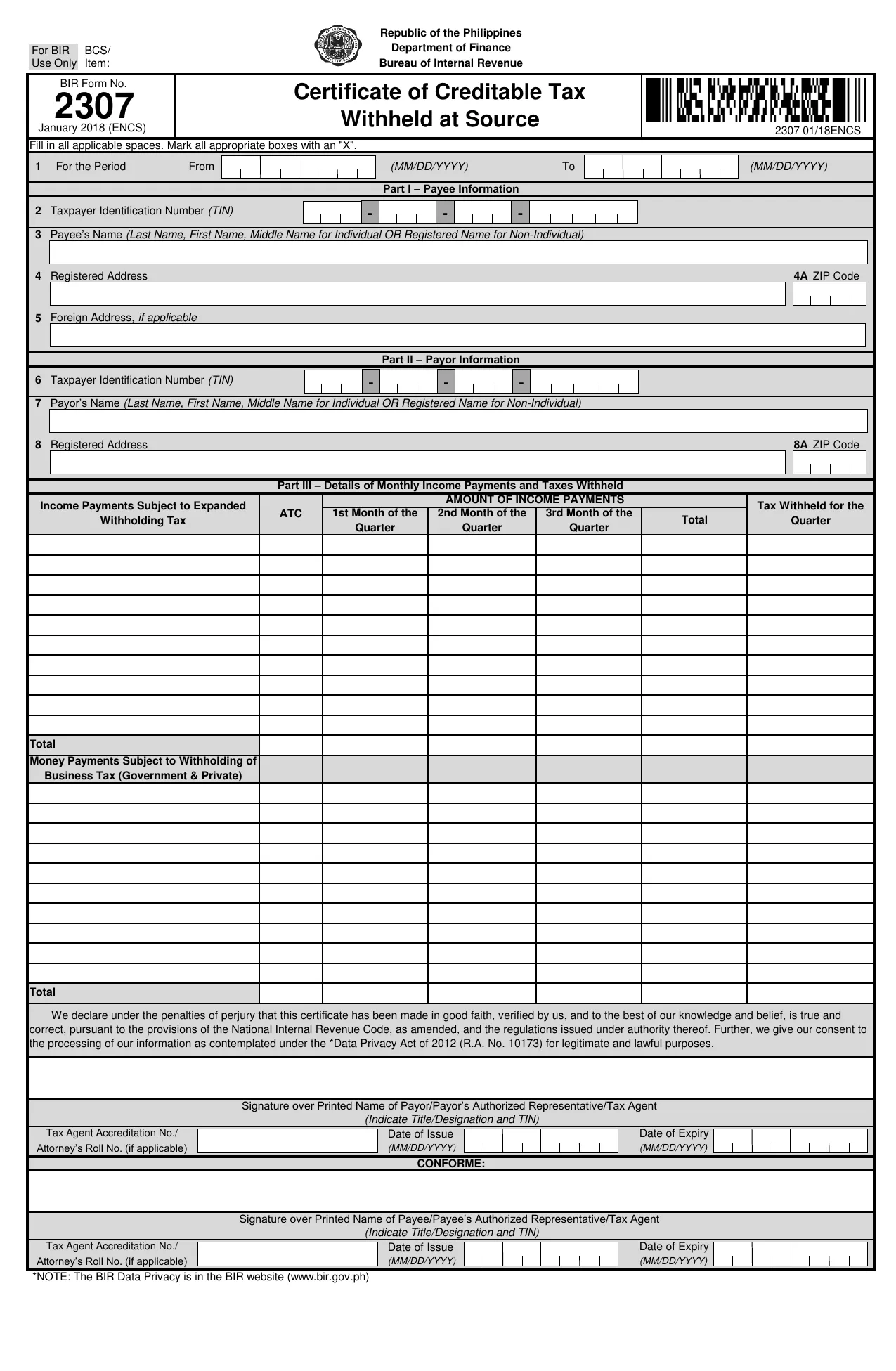

Fill in all applicable spaces. Mark all appropriate boxes with an "X".

3

Payee’s Name

(Last Name, First Name, Middle Name for Individual OR Registered Name for Non-Individual)

4

Registered Address

4A

ZIP Code

5

Foreign Address,

if applicable

7

Payor’s Name

(Last Name, First Name, Middle Name for Individual OR Registered Name for Non-Individual)

8

Registered Address

8A

ZIP Code

*NOTE: The BIR Data Privacy is in the BIR website (www.bir.gov.ph)

Certificate of Creditable Tax

Withheld at Source

For the Period

1

Republic of the Philippines

Department of Finance

Bureau of Internal Revenue

2

Taxpayer Identification Number

(TIN)

Part II – Payor Information

6

Taxpayer Identification Number

(TIN)

(MM/DD/YYYY)

To

From

(MM/DD/YYYY)

Part I – Payee Information

Part III – Details of Monthly Income Payments and Taxes Withheld

Tax Withheld for the

Quarter

ATC

Income Payments Subject to Expanded

Withholding Tax

AMOUNT OF INCOME PAYMENTS

1st Month of the

Quarter

2nd Month of the

Quarter

3rd Month of the

Quarter

Total

Total

Money Payments Subject to Withholding of

Business Tax (Government & Private)

Total

Date of Expiry

(MM/DD/YYYY)

Tax Agent Accreditation No./

Attorney’s Roll No. (if applicable)

Date of Issue

(MM/DD/YYYY)

We declare under the penalties of perjury that this certificate has been made in good faith, verified by us, and to the best of our knowledge and belief, is true and

correct, pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof. Further, we give our consent to

the processing of our information as contemplated under the *Data Privacy Act of 2012 (R.A. No. 10173) for legitimate and lawful purposes.

Signature over Printed Name of Payor/Payor’s Authorized Representative/Tax Agent

(Indicate Title/Designation and TIN)

CONFORME:

Signature over Printed Name of Payee/Payee’s Authorized Representative/Tax Agent

(Indicate Title/Designation and TIN)

Tax Agent Accreditation No./

Date of Issue

(MM/DD/YYYY)

Date of Expiry

Attorney’s Roll No. (if applicable)

(MM/DD/YYYY)

For BIR

Use Only

BCS/

Item:

2307

January 2018 (ENCS)

BIR Form No.

2307 01/18ENCS

-

-

-

-

-

-

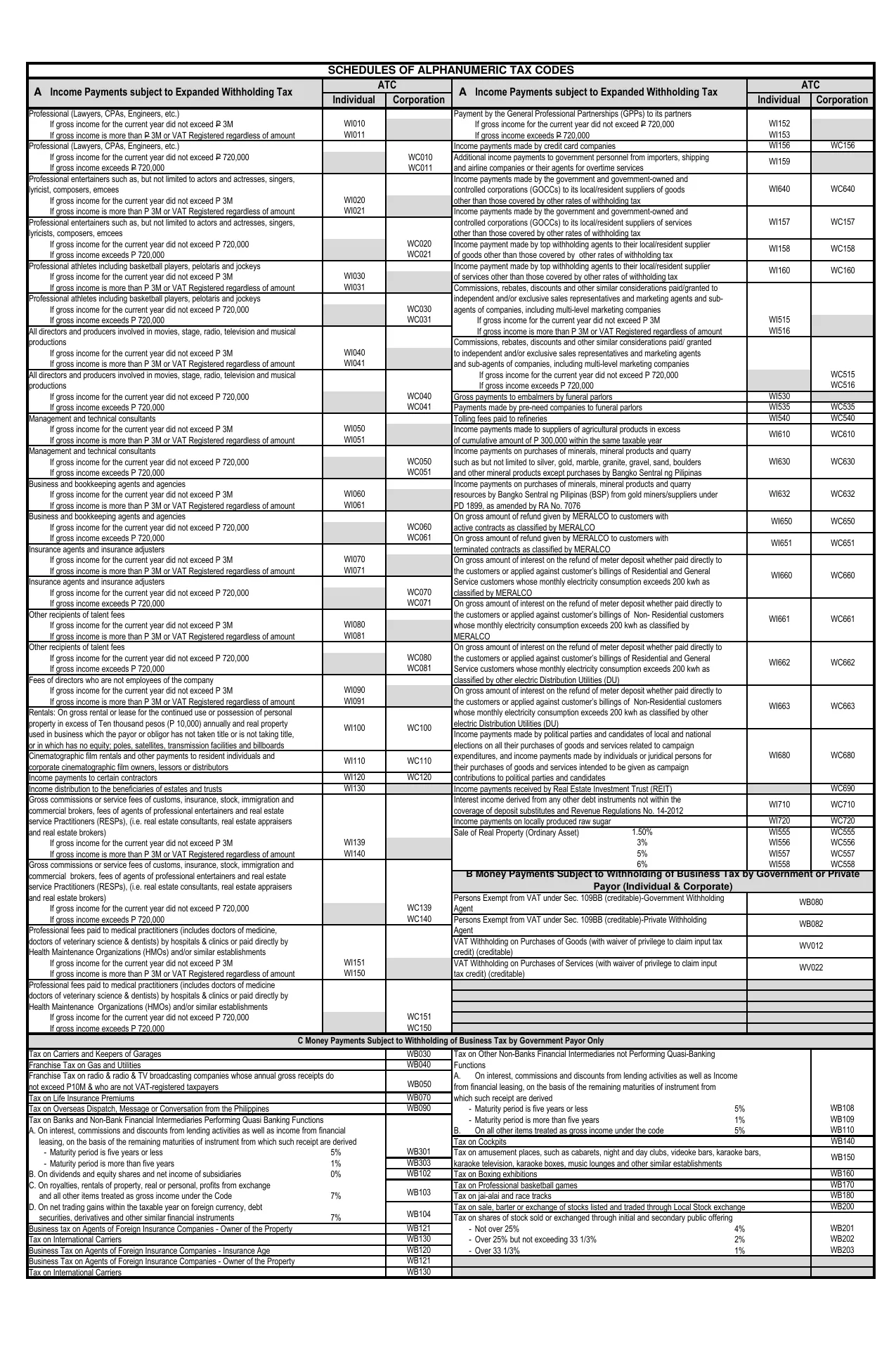

Professional (Lawyers, CPAs, Engineers, etc.)

Payment by the General Professional Partnerships (GPPs) to its partners

If gross income for the current year did not exceed P 3M

If gross income for the current year did not exceed P 720,000

If gross income is more than P 3M or VAT Registered regardless of amount

If gross income exceeds P 720,000

Professional (Lawyers, CPAs, Engineers, etc.)

Income payments made by credit card companies

If gross income for the current year did not exceed P 720,000

WC010

Additional income payments to government personnel from importers, shipping

If gross income exceeds P 720,000

WC011

and airline companies or their agents for overtime services

Professional entertainers such as, but not limited to actors and actresses, singers,

Income payments made by the government and government-owned and

lyricist, composers, emcees

controlled corporations (GOCCs) to its local/resident suppliers of goods

If gross income for the current year did not exceed P 3M

other than those covered by other rates of withholding tax

If gross income is more than P 3M or VAT Registered regardless of amount

Income payments made by the government and government-owned and

Professional entertainers such as, but not limited to actors and actresses, singers,

controlled corporations (GOCCs) to its local/resident suppliers of services

lyricists, composers, emcees

other than those covered by other rates of withholding tax

If gross income for the current year did not exceed P 720,000

Income payment made by top withholding agents to their local/resident supplier

If gross income exceeds P 720,000

of goods other than those covered by other rates of withholding tax

Professional athletes including basketball players, pelotaris and jockeys

Income payment made by top withholding agents to their local/resident supplier

If gross income for the current year did not exceed P 3M

of services other than those covered by other rates of withholding tax

If gross income is more than P 3M or VAT Registered regardless of amount

Commissions, rebates, discounts and other similar considerations paid/granted to

Professional athletes including basketball players, pelotaris and jockeys

independent and/or exclusive sales representatives and marketing agents and sub-

If gross income for the current year did not exceed P 720,000

agents of companies, including multi-level marketing companies

If gross income exceeds P 720,000

If gross income for the current year did not exceed P 3M

All directors and producers involved in movies, stage, radio, television and musical

If gross income is more than P 3M or VAT Registered regardless of amount

productions

Commissions, rebates, discounts and other similar considerations paid/ granted

If gross income for the current year did not exceed P 3M

to independent and/or exclusive sales representatives and marketing agents

If gross income is more than P 3M or VAT Registered regardless of amount

and sub-agents of companies, including multi-level marketing companies

All directors and producers involved in movies, stage, radio, television and musical

If gross income for the current year did not exceed P 720,000

productions

If gross income exceeds P 720,000

If gross income for the current year did not exceed P 720,000

Gross payments to embalmers by funeral parlors

If gross income exceeds P 720,000

Payments made by pre-need companies to funeral parlors

Management and technical consultants

Tolling fees paid to refineries

If gross income for the current year did not exceed P 3M

Income payments made to suppliers of agricultural products in excess

If gross income is more than P 3M or VAT Registered regardless of amount

of cumulative amount of P 300,000 within the same taxable year

Management and technical consultants

Income payments on purchases of minerals, mineral products and quarry

If gross income for the current year did not exceed P 720,000

such as but not limited to silver, gold, marble, granite, gravel, sand, boulders

If gross income exceeds P 720,000

and other mineral products except purchases by Bangko Sentral ng Pilipinas

Business and bookkeeping agents and agencies

Income payments on purchases of minerals, mineral products and quarry

If gross income for the current year did not exceed P 3M

resources by Bangko Sentral ng Pilipinas (BSP) from gold miners/suppliers under

If gross income is more than P 3M or VAT Registered regardless of amount

PD 1899, as amended by RA No. 7076

Business and bookkeeping agents and agencies

On gross amount of refund given by MERALCO to customers with

If gross income for the current year did not exceed P 720,000

active contracts as classified by MERALCO

If gross income exceeds P 720,000

On gross amount of refund given by MERALCO to customers with

Insurance agents and insurance adjusters

terminated contracts as classified by MERALCO

If gross income for the current year did not exceed P 3M

On gross amount of interest on the refund of meter deposit whether paid directly to

If gross income is more than P 3M or VAT Registered regardless of amount

the customers or applied against customer’s billings of Residential and General

Insurance agents and insurance adjusters

Service customers whose monthly electricity consumption exceeds 200 kwh as

If gross income for the current year did not exceed P 720,000

classified by MERALCO

If gross income exceeds P 720,000

On gross amount of interest on the refund of meter deposit whether paid directly to

Other recipients of talent fees

the customers or applied against customer’s billings of Non- Residential customers

If gross income for the current year did not exceed P 3M

whose monthly electricity consumption exceeds 200 kwh as classified by

If gross income is more than P 3M or VAT Registered regardless of amount

MERALCO

Other recipients of talent fees

On gross amount of interest on the refund of meter deposit whether paid directly to

If gross income for the current year did not exceed P 720,000

the customers or applied against customer’s billings of Residential and General

If gross income exceeds P 720,000

Service customers whose monthly electricity consumption exceeds 200 kwh as

Fees of directors who are not employees of the company

classified by other electric Distribution Utilities (DU)

If gross income for the current year did not exceed P 3M

On gross amount of interest on the refund of meter deposit whether paid directly to

If gross income is more than P 3M or VAT Registered regardless of amount

the customers or applied against customer’s billings of Non-Residential customers

Rentals: On gross rental or lease for the continued use or possession of personal

whose monthly electricity consumption exceeds 200 kwh as classified by other

property in excess of Ten thousand pesos (P 10,000) annually and real property

electric Distribution Utilities (DU)

used in business which the payor or obligor has not taken title or is not taking title,

Income payments made by political parties and candidates of local and national

or in which has no equity; poles, satellites, transmission facilities and billboards

elections on all their purchases of goods and services related to campaign

Cinematographic film rentals and other payments to resident individuals and

expenditures, and income payments made by individuals or juridical persons for

corporate cinematographic film owners, lessors or distributors

their purchases of goods and services intended to be given as campaign

Income payments to certain contractors

contributions to political parties and candidates

Income distribution to the beneficiaries of estates and trusts

Income payments received by Real Estate Investment Trust (REIT)

Gross commissions or service fees of customs, insurance, stock, immigration and

Interest income derived from any other debt instruments not within the

commercial brokers, fees of agents of professional entertainers and real estate

coverage of deposit substitutes and Revenue Regulations No. 14-2012

service Practitioners (RESPs), (i.e. real estate consultants, real estate appraisers

Income payments on locally produced raw sugar

and real estate brokers)

Sale of Real Property (Ordinary Asset)

If gross income for the current year did not exceed P 3M

If gross income is more than P 3M or VAT Registered regardless of amount

Gross commissions or service fees of customs, insurance, stock, immigration and

commercial brokers, fees of agents of professional entertainers and real estate

service Practitioners (RESPs), (i.e. real estate consultants, real estate appraisers

and real estate brokers)

Persons Exempt from VAT under Sec. 109BB (creditable)-Government Withholding

If gross income for the current year did not exceed P 720,000

Agent

If gross income exceeds P 720,000

Persons Exempt from VAT under Sec. 109BB (creditable)-Private Withholding

Professional fees paid to medical practitioners (includes doctors of medicine,

Agent

doctors of veterinary science & dentists) by hospitals & clinics or paid directly by

VAT Withholding on Purchases of Goods (with waiver of privilege to claim input tax

Health Maintenance Organizations (HMOs) and/or similar establishments

credit) (creditable)

If gross income for the current year did not exceed P 3M

VAT Withholding on Purchases of Services (with waiver of privilege to claim input

If gross income is more than P 3M or VAT Registered regardless of amount

tax credit) (creditable)

Professional fees paid to medical practitioners (includes doctors of medicine

doctors of veterinary science & dentists) by hospitals & clinics or paid directly by

Health Maintenance Organizations (HMOs) and/or similar establishments

If gross income for the current year did not exceed P 720,000

If gross income exceeds P 720,000

Tax on Carriers and Keepers of Garages

Tax on Other Non-Banks Financial Intermediaries not Performing Quasi-Banking

Franchise Tax on Gas and Utilities

Functions

Franchise Tax on radio & radio & TV broadcasting companies whose annual gross receipts do

A.

On interest, commissions and discounts from lending activities as well as Income

not exceed P10M & who are not VAT-registered taxpayers

from financial leasing, on the basis of the remaining maturities of instrument from

Tax on Life Insurance Premiums

which such receipt are derived

Tax on Overseas Dispatch, Message or Conversation from the Philippines

- Maturity period is five years or less

5%

Tax on Banks and Non-Bank Financial Intermediaries Performing Quasi Banking Functions

- Maturity period is more than five years

1%

A. On interest, commissions and discounts from lending activities as well as income from financial

B.

On all other items treated as gross income under the code

5%

leasing, on the basis of the remaining maturities of instrument from which such receipt are derived

Tax on Cockpits

- Maturity period is five years or less

5%

Tax on amusement places, such as cabarets, night and day clubs, videoke bars, karaoke bars,

- Maturity period is more than five years

1%

karaoke television, karaoke boxes, music lounges and other similar establishments

B. On dividends and equity shares and net income of subsidiaries

0%

Tax on Boxing exhibitions

C. On royalties, rentals of property, real or personal, profits from exchange

Tax on Professional basketball games

and all other items treated as gross income under the Code

7%

Tax on jai-alai and race tracks

D. On net trading gains within the taxable year on foreign currency, debt

Tax on sale, barter or exchange of stocks listed and traded through Local Stock exchange

securities, derivatives and other similar financial instruments

7%

Tax on shares of stock sold or exchanged through initial and secondary public offering

Business tax on Agents of Foreign Insurance Companies - Owner of the Property

- Not over 25%

4%

Tax on International Carriers

- Over 25% but not exceeding 33 1/3%

2%

Business Tax on Agents of Foreign Insurance Companies - Insurance Age

- Over 33 1/3%

1%

Business Tax on Agents of Foreign Insurance Companies - Owner of the Property

Tax on International Carriers

WB120

WB203

WB121

WB130

WB103

WB170

WB180

WB104

WB200

WB121

WB201

WB130

WB202

WB090

WB108

WB109

WB110

WB140

WB301

WB150

WB303

WB102

WB160

WC151

WC150

C Money Payments Subject to Withholding of Business Tax by Government Payor Only

WB030

WB040

WB050

WB070

B Money Payments Subject to Withholding of Business Tax by Government or Private

Payor (Individual & Corporate)

WB080

WC139

WC140

WB082

WV012

WI151

WV022

WI150

WI139

3%

WI556

WC556

WI140

5%

WI557

WC557

6%

WI558

WC558

WI130

WC690

WI710

WC710

WI720

WC720

1.50%

WI555

WC555

WI662

WC662

WC080

WC081

WI090

WI663

WC663

WI091

WI100

WC100

WI680

WC680

WI110

WC110

WI120

WC120

WC061

WI651

WC651

WI070

WI660

WC660

WI071

WC070

WC071

WI661

WC661

WI080

WI081

WI630

WC630

WC050

WC051

WI632

WC632

WI060

WI061

WI650

WC650

WC060

WC041

WI535

WC535

WI540

WC540

WI050

WI610

WC610

WI051

WI516

WI040

WI041

WC515

WC516

WC040

WI530

WI160

WC160

WI030

WI031

WC030

WC031

WI515

WI640

WC640

WI020

WI021

WI157

WC157

WC020

WI158

WC158

WC021

WI010

WI152

WI011

WI153

WI156

WC156

WI159

SCHEDULES OF ALPHANUMERIC TAX CODES

A

Income Payments subject to Expanded Withholding Tax

ATC

A

Income Payments subject to Expanded Withholding Tax

ATC

Individual

Corporation

Individual

Corporation